The higher a borrower's credit score, the more favorable the interest price they may acquire. Anything at all larger than 750 is considered fantastic and may acquire the top desire costs. From your viewpoint of a lender, They're extra hesitant to lend to borrowers with minimal credit rating scores and/or a historical past of individual bankruptcy and missed charge card payments than they might be to borrowers with cleanse histories of well timed property finance loan and car payments.

The ultimate cost of a new motor vehicle received’t be the same as its MSRP (or sticker value), but it is a good area to get started on if you'll want to estimate.

Borrowers with bad credit may qualify for a lousy-credit score particular loan, however, you are able to enhance your possibilities of qualifying and lessen your fee by acquiring a joint, co-signed or secured individual loan.

If you took out a foul credit score loan to consolidate bank card personal debt, your charge could possibly be near to 36 p.c — and that might be eating into your regular budget. But In case your credit rating rating has climbed earlier mentioned 670, you may perhaps qualify for a charge 10 percent or even more lessen for a great credit loan.

Just like the market for goods and services, the market for credit score is determined by offer and demand, albeit to the lesser extent. When there exists a surplus of desire for cash or credit history, lenders respond by increasing interest costs.

To put it briefly, you will not be capable of finding a zero-interest individual loan from a traditional lender. Nevertheless, there are actually related financing possibilities that don't have a level connected for any stretch of time. 0 percent APR bank cards and buy now, spend afterwards (BNPL) solutions are both equally examples.

Whatever the route you end up picking, the opposite man or woman is equally to blame for the every month payment, so it’s significant that you are aware of you could afford to pay for it. Wherever can you obtain an $80,000 personal loan?

House equity loans Property fairness loans Enable you to borrow a lump sum at a hard and fast level, according to the amount of of the house you individual outright.

Organization books and information, functioning techniques, or another details foundation, such as lists or other facts concerning existing or future clients

Depending upon the lender or establishment, the applying and acceptance system for private loans is commonly immediate and you will get the resources disbursed in a lump sum amount inside a single to two enterprise days.

House equity loan or HELOC: The primary benefit of this borrowing choice is the ability to get funding at for a longer time phrases than private loans enable. Nonetheless it doesn’t arrive without having threat — your house is on the line and you must have sizeable fairness in your home so that you can qualify.

Fascination is computed on The existing amount owed and thus will turn into progressively scaled-down given that the principal decreases. It is possible to determine this in action over the amortization desk.

Get-now, shell out later loans are installment loans that allow you to break up your invest in into four to 6 curiosity-free of charge payments. Many online vendors and several physical stores click here present these providers, and a few Bodily retailers.

Desire costs on private loans presently range between about 6 p.c to 36 %. The lessen conclude of this array is preferable, but you will also choose to take into account the repayment period; the more time your repayment period, the more curiosity you pays with time.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Ashley Johnson Then & Now!

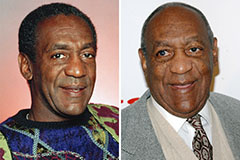

Ashley Johnson Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!